Reimagine Your Banking Experience with Intelligent AI Solutions

Why Fintech Startups Need Smarter AI Solutions

Customer Experience Personalization

Advanced Fraud Detection & Risk Management

Operational Cost Optimization

Automated Credit Scoring & Risk Assessment

Solving hardcore fintech problems using AI

Empower Your Banking Services with the AI Powered Solutions

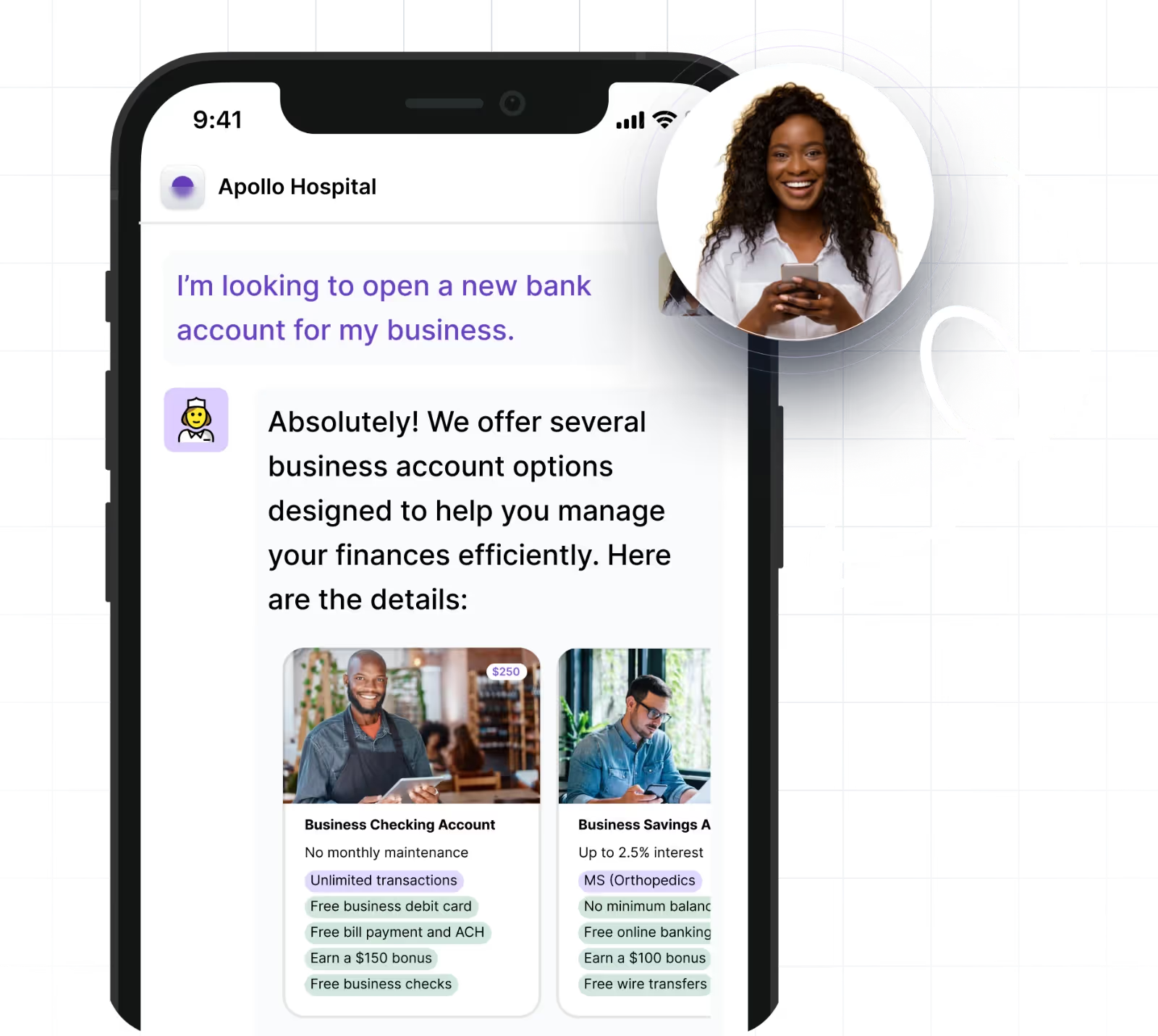

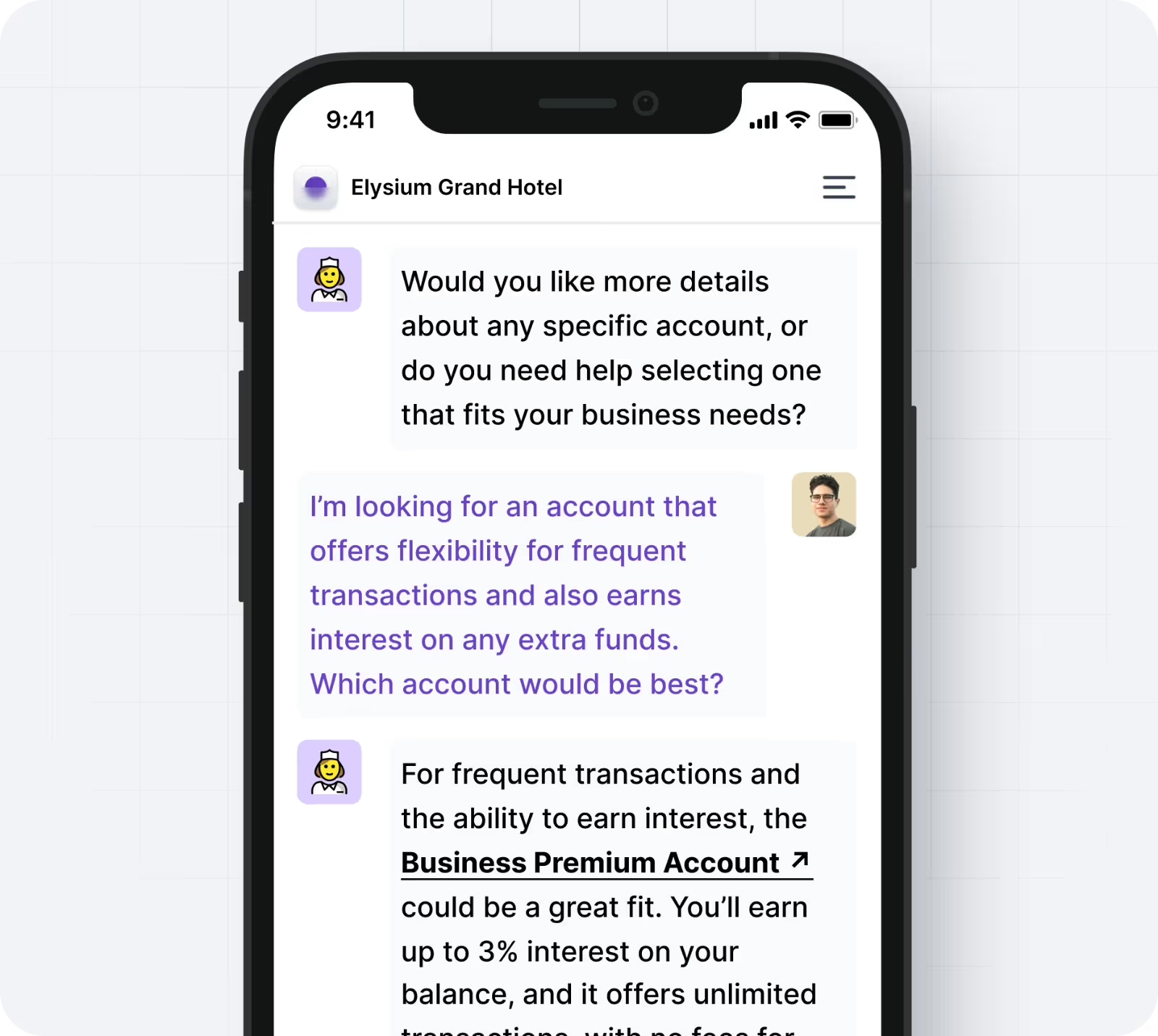

24/7 Customer Support

Comprehensive Banking Services at a Click

Secure Transactions

Universal Integration

Effortless Implementation, Outstanding Results

Implementing the Banking Assistant Bot is a straightforward process that ensures maximum efficiency and minimum disruption to your existing operations. Here’s how it works:

Integrate with Your Existing Systems

The bot integrates seamlessly with your bank’s existing infrastructure, including core banking systems, customer support platforms, and more. This ensures a smooth transition without downtime or complications.

Configure & Customize

Tailor the bot’s functionalities and responses to match your bank’s specific services and tone. Whether you want it to handle simple balance inquiries or complex loan applications, the bot can be fully customized to suit your needs.

Go Live & Assist

Once configured, launch the bot to start providing instant assistance to your customers. The bot can handle high volumes of queries, transactions, and services, all while maintaining secure and personalized interactions.

Monitor & Optimize

After the bot is live, you can monitor its performance and customer interactions. The system will provide recommendations for optimization, ensuring that it continues to meet customer expectations and adapt to their needs over time.

Data Security You Can Trust

At Monday Labs, we understand that security is paramount for financial institutions. That’s why the Banking Assistant Bot is built with the highest security standards in the industry, ensuring that every customer interaction and transaction is safe.